Aire Street

Location: Aire Street, Goole, DN14 5QW

Type: Development

Net Yield: 8.74%

5 year ROI remortgaged: 261%

Gross Yield: 10.41%

Net Yield Remortgaged: 19.94%

Annual Income: £140,529

Restaurant, 2 Shops, Salon & 11 Flats

£1,350,000

View Property

Doncaster Road

Location: 19 Doncaster Road, Selby, YO8 9BS

Type: HMO

Net Yield: 8.02%

5 year ROI remortgaged: 246%

Gross Yield: 9.74%

Net Yield Remortgaged: 17.07%

Annual Income: £31,671

4 Rooms & 2 Flats

£325,000

View Property

Fifth Avenue

Location: 11-13 Fifth Avenue, Goole, DN14 6JD

Type: HMO

Net Yield: 9.46%

5 year ROI remortgaged: 275%

Gross Yield: 13.00%

Net Yield Remortgaged: 22.82%

Annual Income: £52,000

15 Bedrooms

£400,000

View Property

Humber Street

Location: 27 Humber Street, Goole, DN14 5UJ

Type: Buy-to-Let

Net Yield: 8.85%

Gross Yield: 9.53%

Net Yield Remortgaged: 20.41%

Annual Income: £8,100

Occupancy: Empty

£85,000

View Property

Kitchen Drive

Location: 9 Kitchen Drive, Selby, YO8 8EA

Type: Buy-to-Let

Net Yield: 7.34%

Gross Yield: 7.89%

Net Yield Remortgaged: 14.35%

Annual Income: £8,280

Occupancy: Tenanted

£105,000

View Property

Adeline Street

Location: 74 Adeline Street, Goole, DN14 6DJ

Type: Buy-to-Let

Net Yield: 6.59%

Gross Yield: 7.14%

Net Yield Remortgaged: 11.38%

Annual Income: £7,500

Occupancy: Tenanted

£105,000

View Property

Parliament Street

Location: 47 Parliament Street, Goole, DN14 6SP

Type: Buy-to-Let

Net Yield: 8.09%

Gross Yield: 8.71%

Net Yield Remortgaged: 17.36%

Annual Income: £8,100

Occupancy: Tenanted

£93,000

View Property

Silvertree Walk

Location: 24 Silvertree Walk, Goole, DN14 5XW

Type: Buy-to-Let

Net Yield: 6.26%

Gross Yield: 6.72%

Net Yield Remortgaged: 10.04%

Annual Income: £8,400

Occupancy: Tenanted

£125,000

View Property

Paradise Place

Location: Flat 5, Goole, DN14 5DL

Type: Buy-to-Let

Net Yield: 7.74%

Gross Yield: 8.60%

Net Yield Remortgaged: 15.95%

Annual Income: £5,760

Occupancy: Tenanted

£67,000

View Property

Paradise Place

Location: Flat 2, Goole, DN14 5DL

Type: Buy-to-Let

Net Yield: 7.98%

Gross Yield: 8.86%

Net Yield Remortgaged: 16.90%

Annual Income: £5,760

Occupancy: Tenanted

£65,000

View Property

Marshland Road

Location: 44D Marshland Road, Doncaster, DN8 4PB

Type: Buy-to-Let

Net Yield: 8.76%

Gross Yield: 10.20%

Net Yield Remortgaged: 20.04%

Annual Income: £4,080

Occupancy: Tenanted

£40,000

View Property

Marshland Road

Location: 44B Marshland Road, Doncaster, DN8 4PB

Type: Buy-to-Let

Net Yield: 8.76%

Gross Yield: 10.20%

Net Yield Remortgaged: 20.04%

Annual Income: £4,080

Occupancy: Tenanted

£40,000

View Property

Fourth Avenue

Location: 38 Fourth Avenue, Goole, DN14 6JE

Type: Buy-to-Let

Net Yield: 7.79%

Gross Yield: 8.47%

Net Yield Remortgaged: 16.17%

Annual Income: £7,200

Occupancy: Tenanted

£85,000

View Property

Tennyson St

Location: 17 Tennyson Street, Goole, DN14 6EB

Type: Buy-to-Let

Net Yield: 8.12%

Gross Yield: 8.76%

Net Yield Remortgaged: 17.47%

Annual Income: £7,800

Occupancy: Empty

£89,000

View Property

Edinburgh Street

Location: 54 Edinburgh Street, Goole, DN14 5EH

Type: Buy-to-Let

Net Yield: 8.15%

Gross Yield: 8.82%

Net Yield Remortgaged: 17.58%

Annual Income: £7,500

Occupancy: Tenanted

£85,000

View Property

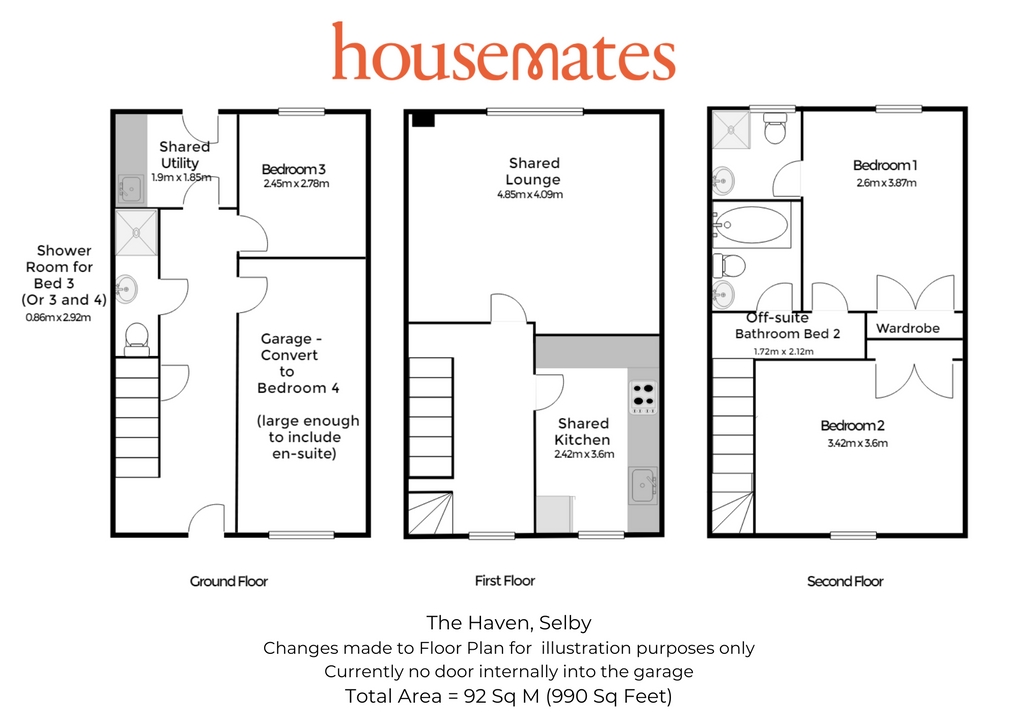

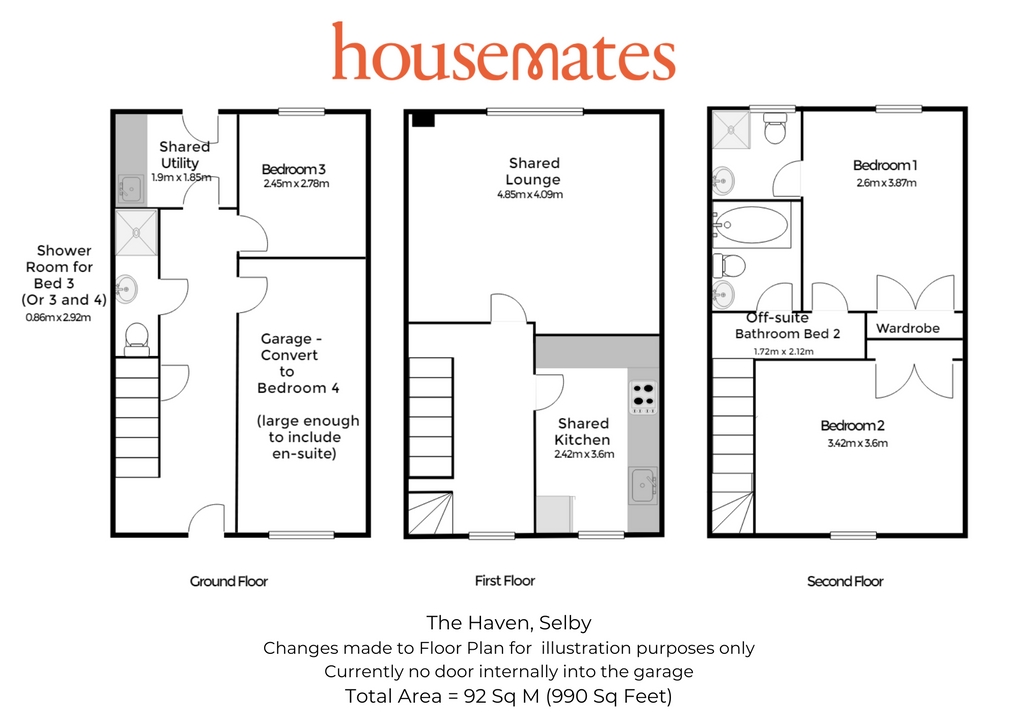

The Haven

Location: 14 The Haven, Selby, YO8 8BJ

Type: HMO

Net Yield: 9.36%

5 year ROI remortgaged: 273%

Gross Yield: 12.86%

Net Yield Remortgaged: 22.45%

Annual Income: £27,133

4 potential bedrooms

£211,000

View Property

The Haven

Location: 14 The Haven, Selby, YO8 8BJ

Type: Buy-to-Let

Net Yield: 5.13%

Gross Yield: 5.40%

Net Yield Remortgaged: 5.52%

Annual Income: £11,400

Occupancy: Tenanted

£211,000

View Property

Byron Street

Location: 21 Byron Street, Goole, DN14 6EJ

Type: Buy-to-Let

Net Yield: 9.03%

Gross Yield: 9.75%

Net Yield Remortgaged: 21.12%

Annual Income: £7,800

Occupancy: Tenanted

£80,000

View Property

Fifth Avenue

Location: 32 Fifth Avenue, Goole, DN14 6JD

Type: Buy-to-Let

Net Yield: 7.79%

Gross Yield: 8.47%

Net Yield Remortgaged: 16.17%

Annual Income: £7,200

Occupancy: Tenanted

£85,000

View Property

Marlborough Avenue

Location: 12 Marlborough Avenue, Goole, DN14 6JA

Type: Buy-to-Let

Net Yield: 7.94%

Gross Yield: 8.59%

Net Yield Remortgaged: 16.75%

Annual Income: £7,560

Occupancy: Tenanted

£88,000

View Property

Marlborough Avenue

Location: 69 Marlborough Avenue, Goole, DN14 6JB

Type: Buy-to-Let

Net Yield: 7.60%

Gross Yield: 8.21%

Net Yield Remortgaged: 15.42%

Annual Income: £7,800

Occupancy: Tenanted

£95,000

View Property

Spencer Street

Location: 8 Spencer Street, Goole, DN14 6EF

Type: Buy-to-Let

Net Yield: 8.69%

Gross Yield: 9.42%

Net Yield Remortgaged: 19.75%

Annual Income: £7,440

Occupancy: Tenanted

£79,000

View Property

Sold STC

Swinefleet Road

Location: 91 Swinefleet Road, Goole, DN14 5UN

Type: Buy-to-Let

Net Yield: 10.82%

Gross Yield: 11.40%

Net Yield Remortgaged: 28.30%

Annual Income: £11,400

Occupancy: Empty

£100,000

View Property

Sold STC

Weatherill Street

Location: 12 Weatherill Street, Goole, DN14 6EN

Type: Buy-to-Let

Net Yield: 6.97%

Gross Yield: 7.58%

Net Yield Remortgaged: 12.89%

Annual Income: £7,200

Occupancy: Tenanted

£95,000

View Property

Sold STC

Henry Street

Location: 21 Henry Street, Goole, DN14 6TQ

Type: Buy-to-Let

Net Yield: 7.45%

Gross Yield: 8.00%

Net Yield Remortgaged: 14.81%

Annual Income: £8,400

Occupancy: Tenanted

£105,000

View Property

Sold STC

Manuel Street,

Location: 43 Manuel Street, Goole, DN14 6TJ

Type: Buy-to-Let

Net Yield: 6.31%

Gross Yield: 6.86%

Net Yield Remortgaged: 10.23%

Annual Income: £7,200

Occupancy: Tenanted

£105,000

View Property